You’ll love this list of little-known credit card perks!

When most people think about credit card offers, they think of the basics. This could mean they generally use it to pay for things without cash and get conveniently billed for all their charges once a month, all while earning a few rewards.

Credit cards also offer the convenient option to pay for what you buy over time. But we’re against using a credit card that way because the interest rates are usually outrageous. But, many companies also come with some extra little-known credit card perks.

Some benefits may even delight and excite you so much that you’ll think it’s worth paying an annual fee for a card.

So, let’s dive into our 6 favorite little-known credit card perks, many of which you may need to learn about and others you might even already have on your current credit card and not know about.

Return protection

Some issuers, including American Express, offer return protection if you wanted to return something at a store but were denied. You might be reimbursed for the item if your credit card company has this little-known credit card perk. There will obviously be some restrictions.

For instance, jewelry, small and large electronics, and books are often excluded. American Express does limit this perk to $300 per item and $1,000 per card member account on a calendar year.

If your clothing article fits within the list of eligible returns, you must send it back, covering that cost. And give your credit card issuer the proper documentation that you tried to return that item.

This little-known credit card perk entails your original receipt, a copy of the statement you charged it on, and the retailer’s return policy information. If everything goes according to plan, that money will be put back into your account.

Free money from statement credits

There’s no better little-known credit card perk than free money! Because credit cards have become more expensive over time, companies have added monthly and yearly credits to some of their cards as a benefit to justify the cost.

For instance, the Chase Sapphire Reserve has a fantastic deal. You may have heard about this company’s $300 annual travel credit, used on a wide variety of expenses for travel, including commuter trains, ride-shares, and even parking.

If you can use up all that credit throughout the year, you’d only pay $250 yearly for the card. And if you’re looking for a card with lots of these annual credits, take a closer look at The Platinum Card from American Express.

It includes up to $200 in annual Uber Cash, up to $200 in annual airline fee credits, up to $240 in digital yearly entertainment credits, up to $100 in yearly Saks Fifth Avenue credits, up to $189 in annual Clear membership credits and a few other little-known credit card perks.

If you use them all in a year, those $919 in credits quickly pay the card’s $695 annual fee. If you don’t want to spend $695 a year, how about the American Express Gold Card?

It has a $250 annual fee but still includes up to $120 in yearly dining credits and $120 in annual Uber Cash. Still too much money to spend on a yearly fee?

Then, let’s look at the classic Chase Sapphire Preferred Card. At $95 a year, it’s a great starter travel credit card offer that lets you earn points that can be redeemed for travel or cash back or even transferred to 14 hotel and airline partners.

In addition, Chase Sapphire Preferred cardholders have access to a free DashPass membership.

Discounts on services and goods

You might qualify for exclusive cardholder discounts depending on your credit card issuer. You can do your favorite things at a lower cost if you take advantage of this little-known credit card perk.

Retailers link up with credit card companies to give cardholders special discounts or cashback rewards on what they buy. For instance, American Express has Amex Offers, Bank of America offers BankAmeriDeals, and Chase has launched Chase Offers.

What’s available at any given time will be advertised on the card company’s app or website or sometimes even emailed to you. Another great example comes from Mastercard. Elite cardholders can get $5 off every Postmates purchase of $25 or more.

Taking advantage of this little-known credit card perk is easy: determine what you’re interested in by activating the offer on the card’s app and then charge the purchase to your card. At check-out, the discount or extra cashback points will be applied instantly.

So, we recommend fully exploring all the benefits that can help you save more money.

Cell phone protection

This is a little-known credit card perk that wasn’t standard until recently. But we’re now seeing it available on more and more cards.

And with almost everyone using their cell phone as a lifeline to the world, it’s fantastic to be able to protect yourself from the cost of a massive replacement or repair if something unexpectedly happens to your phone. Cell phone protection is what it sounds like.

If your phone gets damaged or stolen, your card company will reimburse you for replacing or repairing it.

If you want to be covered if the worst happens, you must have paid off your monthly phone bill the previous month with a credit card that offers this little-known credit card perk. And not all protection coverage is the same.

Every card has coverage maximums, ranging between $600 and $1,000 per claim, depending on the company. There’s also a deductible between $25 and $100, and most cards have a maximum amount of shares you can make yearly. Some of these cards are pretty expensive.

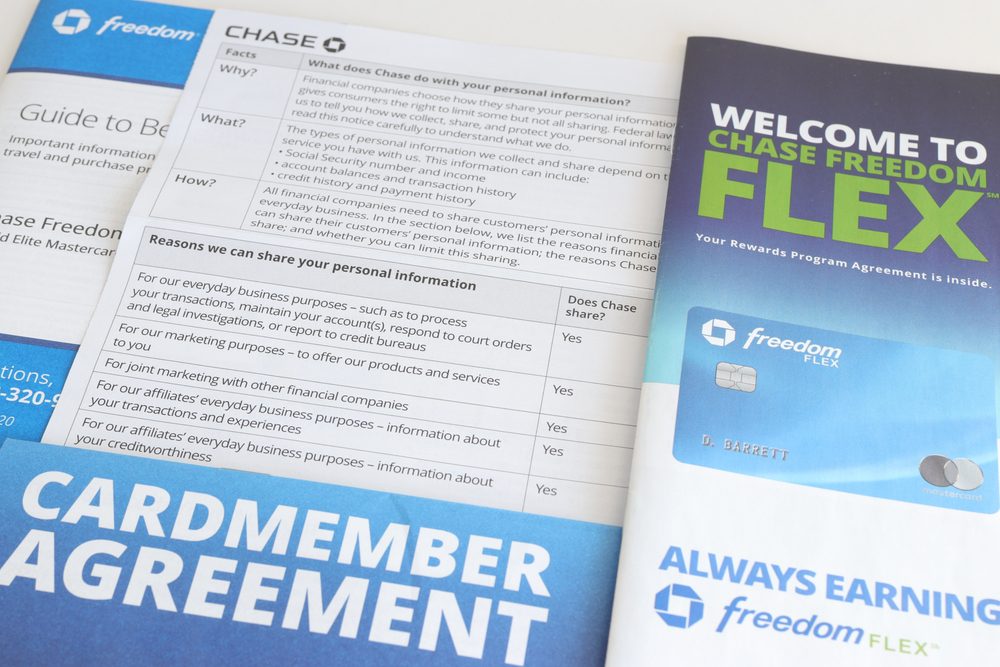

But if you do your research, you can get this perk on cards without any annual fees. For instance, the Chase Freedom Flex provides up to $800 per claim and $1,000 a year against covered damage or theft, with a $50 deductible on each claim and a maximum of two shares in a year.

Not only does it have no annual fee, but it also earns 5% cash back on travel booked through them, makes 3% cash back at drugstores and on dining. It also has another set of bonus categories that change quarterly and earn 5% cash back, up to $1,500 in purchases annually.

Extended warranty protection

A credit card’s extended warranty protection might stretch an original manufacturer’s warranty, sometimes longer than a year, depending on the terms of your contract. No matter what type of purchase you make, the savings can begin to add up.

According to research done by Consumer Reports, the average price for an extended warranty on a major appliance is about $131. For a smaller device, it’s about $19. Either way, it’s money that your credit card can save for you.

Now, it’s true that some companies have stopped offering this benefit in recent years. But those that still have this policy usually cover what’s included in the original manufacturer’s warranty.

To qualify for this little-known credit card perk, the item must be bought with the eligible card. Exclusions may also apply to some products like computer software and cars.

Travel insurance

Many credit cards offer coverage for free travel insurance that protects you from losing money if you have to cancel or your flight is delayed.

Unlike standard travel insurance, credit cards offer detailed protections that vary significantly from card to card, with one of the most helpful protections including trip cancellation insurance.

Having one of these credit cards could save you a lot of money on your next vacation. A baggage delay refund will also pay for temporary supplies like toiletries and clothing if your bag doesn’t show up.

In severe cases, some credit card offers come with emergency evacuation insurance. This means that they’ll pay for transportation and medical services if you get sick or injured somewhere far away from home.

If your credit card offers any of these travel protections, you’ll need to use that card to pay for at least a part of your trip to be covered.

So, if you’re nervous about booking a trip and then having to cancel it, make sure you pay for your trip with a card that offers the correct type of travel insurance, and check the terms in your contract so you’re clear on all the rules of this little-known credit card perk.

Speaking of taking trips, don’t forget the most important part. If you’re luggage set has gotten old, Amazon is here to the rescue!

Did you know about these little-known credit card perks? Be sure to let us know how they work out for you.

In the meantime, if you’re looking for even more fantastic savings, we highly recommend you also read: 10 Free Valuable Items You Can Score Right NOW!